Building A Go-To-Market Strategy to Fuel Growth: Three Banks That Are Growing Through Focus

In my last blog, I made the case that a community bank can grow faster and more efficiently than its peers by developing and executing a focused Go-To-Market (GTM) strategy.

I laid out the five basic questions that banks must answer in developing a GTM strategy and then shared three examples of community banks who were executing well on their GTM strategy:

- First National Bank of Hereford, a Texas bank focused on serving regional agricultural clients.

- Associated Bank, Wisconsin, delivered insights and products focused on serving specific middle-market industries in its markets.

- Live Oak Bank, North Carolina, focused its expertise, products, and technology solutions specifically for small businesses.

Each of these banks aligned their messaging, products, and services to their target market segments, proactively answering the question of: “Why should I do business with this bank versus another one?” Each of these banks have been growing faster than their peers.

We have studied scores of banks, and unfortunately, very few have developed a focused GTM strategy. For years, banks got stuck in a brick-and-mortar business model where growth was achieved by adding/acquiring branches to bring their brand to new markets.

But this legacy model has been challenged by digital banking, neo-banks, and non-banks where growth is all about bringing improved technology and solutions to narrowly-focused target markets.

Fortunately, with the help of my data analyst, I did find a group of community banks that are growing much faster than their peers.

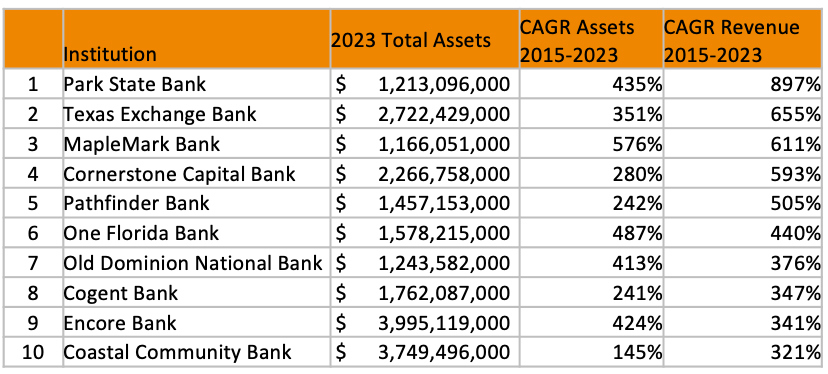

Community Banks with $1-5 Billion in 2023 Assets

Ranked by CAGR in Revenue, 2015-2023

Using the BankRegData platform that pulls from FDIC Call Reports, we ranked 708 banks with assets between $1 – 5 billion as of year-end 2023. The average growth rate of these 708 banks was 55% and the median was 34%. Only 234 of the 708 were above average. But these three banks below grew 897%, 440% and 321% respectively. Here are some observations to help explain that growth:

# 1 – Park State Bank, Duluth, MN. https://www.parkstatebank.com/

Park State Bank has been a # 1 top performer in Minnesota many times since 2018 and it ranked first in our analysis here. Upon hitting their website, I immediately liked this bank for its storytelling which makes its brand relevant, real and accessible. It displays its business banking solutions first and makes it locally-focused business bankers visible and easy to contact by phone or email.

On the personal banking side, they make it easy for a consumer to select a product solution based on their needs. And they make it easy for community organizations to apply for a grant, and easy for customers to nominate an employee who has “wowed” them. They are succeeding by staying focused on people-first, local expertise and pursuing digital convenience.

# 6 – One Florida Bank, Orlando, FL. https://www.onefloridabank.com/

One Florida Bank shows a clear and focused GTM strategy by featuring its Treasury Management Services. They clearly want to help middle market businesses to efficiently manage their diverse payment needs and to provide business insight to enable better decisions, risk reduction and peace of mind.

They also offer a full range of personal banking solutions. They have the online/mobile banking and payment solutions that consumers expect, but they have not yet launched online account opening. I am sure that is coming soon. This bank demonstrates sophistication, energy, and focus.

# 10 Coastal Community Bank, Everett, WA. https://www.coastalbank.com/

This bank wears it values and commitment to being trusted advisors and knowledge-builders front and center. It’s prominent home page message touts specific small business industries and a small business newsletter. It features a robust business resource center that aggregates relevant information and organizations to help small and mid-sized businesses succeed.

All three of these banks have significant branch networks and are built on the traditional strengths of community banking: People, Expertise, Local Knowledge and Commitment to investing in their communities. As a result, I expect they will continue to grow faster than their peers.

If you would like a free assessment of your bank’s growth versus your state and national peers, let us know via this link: Free Assessment

Princeton Partners is dedicated to Community Bank Success. Learn more at our Financial Services page.