Why the Branch is Still Relevant in the Age of Digital Banking

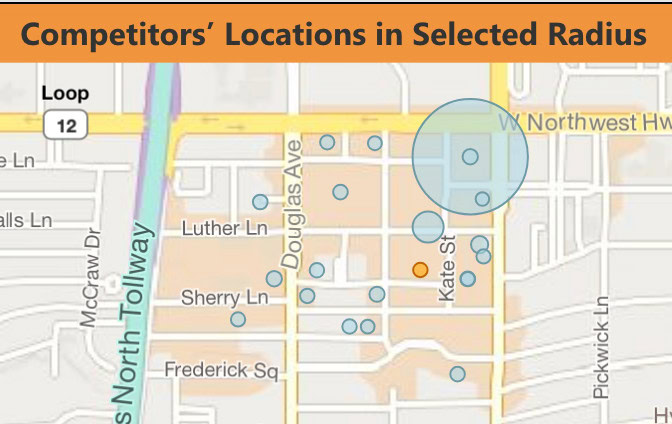

I recently had the opportunity to visit with bank marketing executives of a regional community bank based in Dallas, Texas. Before the visit, I did my usual analysis of the bank’s financial performance relative to its peers. I also used our own Bank Marketing Opportunity Platform to do a geo-spatial analysis of the competitive deposit and market share situation in a selected radius. I was blown away by what I found:

In under a radius of .25 miles, twenty banks have office locations. I walked the area, and I could count the logos of eight different banks from a single spot. I’ve never seen this kind of density before. Of course, this area is both a corporate and retail banking center which has developed along with the economic expansion and prosperity in Dallas. But I thought to myself, “if you’re a bank that wants to be taken seriously in this market, then you have to prove it with your investments in a branch infrastructure and branch personnel.” But isn’t that still the case for branch locations everywhere?

Banks are continuously evaluating their branch footprint and seeking to optimize their network to support growth and profitability. Markets grow and markets decline. Demographics are shifting all the time. Banks optimize their branch networks by determining where they can achieve competitive advantages and gain market share. Here’s a snapshot of the open/closure situation in 2024 for six national banks according to a recent American Banker article.

According to American Banker, Chase is planning to triple its branch presence in Alabama to capture strategic growth opportunities. And, about one year ago, Chase said it would “open more than 500 new branches across the country — and renovate 1,700 more — by 2027.” The multi–billion-dollar effort includes plans for branches in new markets, low- to moderate-income communities and rural communities. Chase is not the only one. Bank of America plans to open 165 by 2026, and PNC has plans to open 100 to 200 branches. Clearly, branches are here to stay, they just change their locations and tweak their design and functionality to be relevant to local–market needs. Here are reasons why banks should consider opening new branches.

- Enhanced Customer Acquisition and Retention – Despite the rise of digital banking, many consumers prefer visiting physical branches for activities such as opening new accounts, receiving financial advice, or purchasing financial products. A study by Cushman & Wakefield highlights that consumers often choose banks based on the convenience of branch locations, underscoring the role of branches in customer acquisition and retention.

- Support for Small Businesses – Local bank branches play a crucial role in supporting small businesses. The relationships between bank staff and local business owners foster trust and confidence, facilitating access to credit. Research from the National Community Reinvestment Coalition indicates that when local branches close, these relationships are disrupted, leading to a decline in small business lending in the affected areas.

- Community Development and Financial Inclusion – Physical bank branches provide tangible benefits to consumers, especially in low- and moderate-income neighborhoods. A study by the Federal Reserve Bank of Cleveland found that the presence of bank branches in these areas leads to lower default rates and greater access to credit for residents. This suggests that branches contribute to community development and financial inclusion by offering essential financial services to underserved populations.

- Strategic Market Expansion – For financial institutions, opening new branches can be a strategic move to expand into new markets or strengthen presence in existing ones. An analysis by The Financial Brand revealed that major banks like Chase have been actively building new branches, focusing on high-growth markets and areas with strong economic fundamentals. This approach allows banks to tap into new customer bases and drive deposit growth.

So, while digital banking continues to grow, research supports the strategic opening of new bank branches as a means to enhance customer engagement, support small businesses, promote community development, and facilitate market expansion.And let’s not forget one of the biggest reasons:to ensure that their brand is visible and make the statement that they are committed to serving the people and businesses in the communities in which they do business.

Other Insightful Resources for Financial Institutions

- The Relationship Between Marketing Investments and Revenue Growth: A White Paper for Community Banks

Princeton Partners is dedicated to Community Bank Success. Learn more at our Financial Services page.