Strategies for Competitive Advantage and Long-Term Growth

I started my first job in the advertising business in 1981, during a recession. I was excited to get a job as an Account Executive in the coveted advertising business where they worked you 60 hours a week and paid peanuts in the early years. The expense account in the waning days of the Mad Men helped a bit. I have weathered, and studied, the four recessions that occurred during my career to understand not just their causes and patterns, but to understand how to help clients in various industries to get through them successfully and to help position them for competitive advantage and growth.

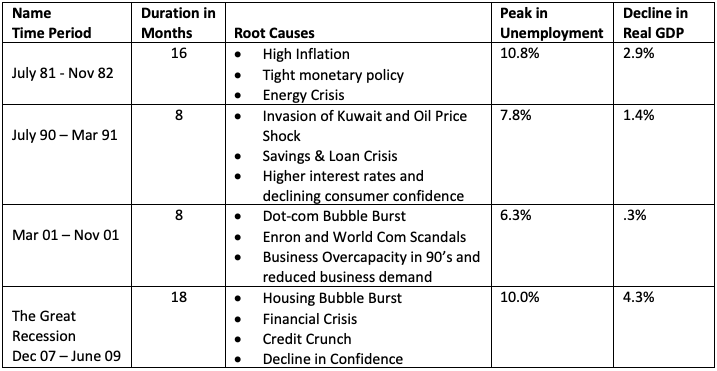

Following is a summary of those recessions. If you were working during these time periods, you will remember, and probably experienced some of the pain of mass lay-offs, reduced disposable income, unstable prices, and the belt tightening and struggles that many businesses, and families, experienced.

Before the Pandemic, I attended a conference in 2019 and learned that some of the major financial institutions were predicting that the next recession would likely occur between late 2022 and late 2023. You only know that you are in a recession after two consecutive quarters of GDP declines. So, we may already be entering that predicted recession – especially with the banking failures we have witnessed this month.

Recessionary patterns have been studied for a long time. Economists examine the patterns of expansion and contraction in the business cycles and many other causal factors. According to the National Bureau of Economic Research, the average duration of expansions has been around 58 months and the average duration has been about 11 months. But the timing and severity of recessions is hard to predict because of the complexity of many inter-related factors and dynamics that affect sentiment and behavior.

I have learned that businesses, even very large businesses, are going to experience financial pressure and face difficult decisions based on macro-economic factors outside their control. But if we know that recessions are a re-occurring and expected part of the balancing of many economic forces, then why aren’t businesses more prepared to not only weather recessions, but to use crisis conditions to make themselves better, stronger and more valuable to their customers, the employees, and their communities?

Our point of view is that whether managing through a recession, or through more normal conditions, there are strategies that all businesses need to understand and apply consistently to their businesses to make them stronger. Personal experience has borne this out.

In early 2001, there was a very sudden and steep manufacturing and business-to-business recession that hurt many of our clients. One client, Yale Materials Handling, a North American forklift company, faced sudden customer order cuts in the tens of thousands. I called Don Chance, Yale’s president, and showed him the business case for gaining market share versus his competitors during this downturn. I pointed to the PIMS studies that demonstrated the many advantages of investing in gaining market share. I also pointed him to the correlation between share of voice (% of ad spend and customer/target awareness in the market) and share of market. His team and ours worked fast and hard to reinvent the allocation of resources to gain share of voice during this time when all his competitors were cutting advertising and going silent. We proactively presented a plan to work fee-free for three months, and to redirect lower priority expenditures to communicating Yale’s brand and commitment to instill confidence to the market at large. We got the message out to dealers and end customers about Yale’s point of difference in working to improve productivity in warehouse operations.

Beyond investing in brand presence when competitors were pulling back, we also recommended to Yale that they pursue a full-on strategy to invest in owning a burgeoning opportunity in the market: becoming known as a fleet management company that could quantify and guarantee productivity. Instead of relying on the existing business model of selling and servicing forklifts, Yale aggressively pursued the path of innovating their business model in order to own the burgeoning fleet management space. They took on responsibility to design and implement a total productivity solution for end clients that lowered their total costs of operations by at least 25%, guaranteed. Yale went on a growth tear and became the leader in fleet management solutions over much larger competitors in a multi-billion-dollar category. The 2001 recession got Yale’s attention and refocused them to pursue and achieve a successful future.

The lesson from the Yale experience is to go on offense when competitors are going on defense. Yale found ways to reallocate resources to gain a dominant share of voice during a critical period. At the same time, they invested in an innovative business model that had already shown promise and doubled down on that model. They came out of the recession with a big lead and stronger growth trajectory than their competitors.

For the next few months, Insight Tuesday will focus on pragmatic strategies to enhance value, competitiveness, growth and profitability. This series will not just be about getting through a recession. It will be about helping organizations to grow their brand and business in any environment.

Next week we will focus on the concept of creating space – the financial pad that both imbues confidence and frees up the mind for innovation.

Gain a competitive edge with our Recession or No Recession series. Subscribe to Read.